APR is a term you commonly see associated with personal loans. The problem is that most people don’t understand what APR really means when it comes down to comparing costs and loan choices.

Luckily, this article explains what APR is, how it works, and what to look for you’re shopping for personal loans. This should help you understand the true cost of a loan before you commit to borrowing.

APR and Personal Installment Loans

APR stands for Annual Percentage Rate. It is meant to represent the actual cost of borrowing throughout the term of your loan, expressed as a percentage rate for convenience.

This rate includes costs such as simple interest charged, fees, and any other additional items that could affect the overall amount. It should provide a number you can use to compare personal installment loans. However, this may not always be the case, so please read on.

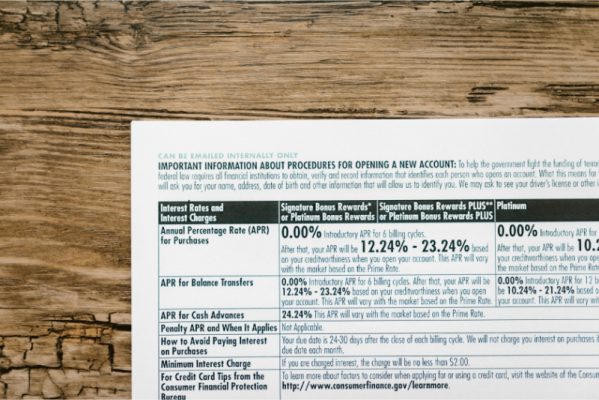

Financial institutions must disclose the APR of their product before you sign your personal loan agreement. Good lenders reveal the Annual Percentage Rate upfront.

APR and Interest Rate Are Not The Same

Don’t confuse the interest rate on a personal loan with the APR. As mentioned, the Annual Percentage Rate includes other costs including interest and fees. The interest rate only describes the amount of interest you will pay over the life of the loan. It is also expressed as a percentage rate, but it does not include additional costs.

As a result, the APR will always be higher than the interest rate on a personal loan. It does not make sense to just compare interest rates since they don’t give you a true picture of cost.

For instance, one personal installment loan could have a low interest rate, but a high Annual Percentage Rate so your costs could be high. Another could have a reasonable interest rate and a reasonable APR so your costs would be better.

Still, lenders can’t keep things that simple. There are also various types of APR. Let’s look at those next.

Types of Annual Percentage Rates

Generally, personal installment loans can have either a variable or fixed APR. Understanding APR types can help you choose which is right for you.

Fixed APR

As the name suggests, a fixed Annual Percentage Rate remains the same throughout the life of the loan. In other words, if your APR is 12.99% when you’re approved it will always be 12.99%. Obviously, a fixed APR makes budgeting a lot easier. However, your APR may be higher than a variable one due to this long-term guarantee.

Variable APR

A variable Annual Percentage Rate can change over the life of the loan as they are usually tied to an index such as the prime rate.

However, variable APR personal loans generally start with lower interest rates. Even though there’s no guarantee the APR will remain the same, one could save you money in a stable financial environment.

Disadvantages of Using APR When Comparing Loans

Even though the Annual Percentage Rate of a personal installment loan is a relatively good comparison tool, it doesn’t necessarily reflect your actual borrowing costs. Why? The following are potential reasons:

Isn’t Foolproof on Its Own

As mentioned earlier, an Annual Percentage Rate is only one factor you should consider when comparing personal loan. While a low APR may seem appealing, you must also look at the interest rate, fees, and other terms.

In some cases, a lower APR can cost you more in the long run. For instance, you could pay more if your loan has a long term, even if it has a low APR, because you’ll pay more interest.

May Not Include All Fees

Annual Percentage Rate calculations rely on formulas and assumptions. However, it is up to the lender whether or not they include certain fees. Examples include origination or application fees and late payment fees. This variation makes it difficult to compare similar products between lenders.

May Not Consider Interest Rate Changes

If you choose a variable-rate loan, your interest rate and APR may change over time. This means that the APR you were initially quoted may not reflect your actual costs over time.

May Not Include Prepayment Penalties

If you plan to pay off your personal loan as soon as possible, you should definitely look at the fine print of the loan first. Some lenders charge prepayment penalties for any amount you pay over your scheduled payments. What’s worse is these penalties aren’t included in the APR, so extra payments could significantly add to your cost of borrowing.

Must Compare Apples to Apples

An Annual Percentage Rate is only a useful comparison tool when you are looking at personal loans with similar terms and repayment schedules. It won’t help you if the repayment structures or terms differ.

Assumes Long-Term Repayment

APR calculations assume repayment schedules of at least a year. Anything shorter than that makes them difficult to calculate. Consequently, the impact of fees on shorter personal installment loans can be greater than anticipated.

How Do You Calculate APR?

Lenders must reveal the Annual Percentage Rate on your personal loan beforehand. Still, your can check the numbers yourself by using this APR calculator to get a good estimation.

Alternatively, you can crunch the numbers using the following calculation:

APR = (((Interest + Fees ÷ Loan amount) ÷ Number of days in loan term) x 365) x 100.

Example

John wants to borrow $5,000. The lender charges a 5% origination fee and offered John a 10% interest rate over a 3-year term. His APR is calculated as follows:

($1,500 + $250 = 1,750) divided by $5,000 =.35

.35 divided by 1095 = .0003196

.0003196 x 365 =.116654

.116654 x 100 = APR 11.67%

What Is a Good APR?

An Annual Percentage Rate on a personal installment loan depends on many factors. Consequently, there’s no one number that constitutes “good”. You just need to find the best possible APR for your circumstances.

Factors that affect Annual Percentage Rate include the current prime rate, how competitive your lending market is, and your credit score. This is only one of the reasons you should aim for a high credit score. At the very least, optimize yours by checking your credit reports for errors.

When the prime interest rate is low, lenders may offer a very low APR to attract borrowers. Still, you’ll want to make sure that the APR offered lasts for the entire length of the personal loan term.

As mentioned, some Annual Percentage Rates are variable and fluctuate with the prime rate. An attractive initial APR might not be so attractive if the prime increases, as it has over the past five years. The current prime rate is double that of 2020 and any variable rate APR would reflect that increase.

Finally, don’t be surprised if the advertised APR isn’t available to you. Unless you have a great credit score, the APR on your personal installment loan will probably be higher. Low APRs are usually reserved for those with especially high credit scores.

Getting the Lowest Cost of Borrowing

To make things easier for you, we’ve made a handy check list. Work your way through it to ensure you have the best chance at paying the least for an installment loan.

- Find the personal installment loans with the lowest APRs. The easiest way to compare them is through a loan broker with access to many lenders. Good lenders offer upfront information on loan fees and APR transparency.

- Look at the overall cost, not just the payment amount. Longer terms offer lower payments, but you also pay much more interest.

- Check for fees. Some lenders charge origination fees, administrative fees, late fees, or prepayment penalties. These increase your cost to borrow and may be excluded from the Annual Percentage Rate by some lenders. Only apply for a loan with clear terms.

- Be realistic. Don’t expect to get a very low APR if you have poor credit. Choose the best offered to you by comparing multiple lenders.

- Only borrow what you need and when you absolutely need it. Just because you can get a personal installment loan, it doesn’t mean you should borrow. Check out our tips for borrowing responsibly

- Choose from the best. Once you’ve done your research, it is just a matter of choosing the best option available to you. Make sure the lender has a good reputation and the installment loan suits your needs and budget.

Find Your Best Installment Loan APR Through FlexMoney

FlexMoney is a transparent and trustworthy lender. We operate online and make it easy to apply for installment loans through a single application form.

Skip the office visits and complicated paperwork. Our automated system simplifies the borrowing process and our process does not affect your credit score. You get near-instant access to multiple lenders, making this by far the best way to check what’s available to you in minutes.

Explore our online lending solutions today. Our network of reputable lenders offer loans of between $200 and $35,000, depending on your needs and personal circumstances.

If you’re looking for the easiest online loans with fast funding, let us help you. Compare APRs, interest rates and terms and find the best personal installment loan available to you with the lowest cost of borrowing.